Indian stock market indexes, such as those of the Sensex and the Nifty 50, are anticipated to begin the week with a cautious tone with hopes of an open that is flat to lower on Monday.

The global sentiment and low-grade indications from the Gift Nifty suggest that market participants should be prepared for a quiet session. This Gift Nifty is trading around 24,925, which is about 25 points lower than Nifty’s closing, suggesting a weaker start in Nifty, the Indian Nifty benchmark.

Also Read: October 18 Stock Picks: Infosys, Wipro, and Axis Bank Lead the Charge

Friday Recap

The domestic equity market halted an eight-day losing streak, providing some relief to investors. The Sensex increased by 218.14 points to close at 81,224.75, While the Nifty 50 gained 104.20 points to close at 24,854.05.

The gains resulted from short covering and a renewed purchasing interest, especially in metal and banking stocks.

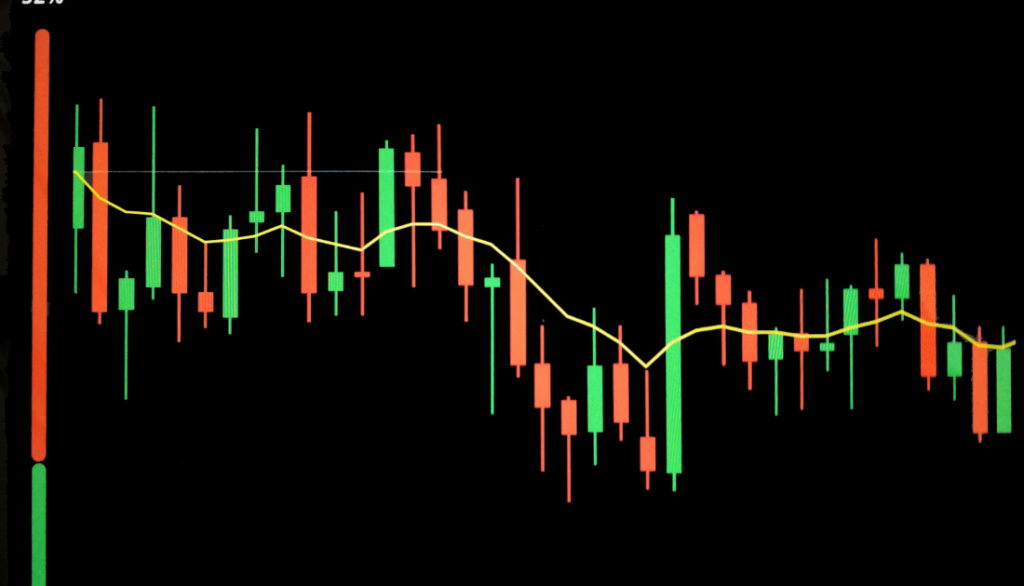

The Nifty 50 exhibited the high wave candlestick pattern on the weekly chart, signalling the market is unsure, and the “Marubozu” pattern was observed on the daily timeframe at the 20-day EMA, indicating an ongoing upward trend. Market analysts are concerned about short-term trading strategies.

In the session on Friday in the market, the Nifty 50 crossed its 20-week EMA and exhibited a decline of 6.5% following the record peak in October. Investors who have a short-term perspective must be cautious. In contrast, those with a long-term view can benefit from the undervalued market on the market.

said VLA Ambala, Co-Founder of Stock Market Today.

Nifty 50: Open Interest Data Points to Key Support Levels

A glance at an analysis of the information on Nifty 50’s options provides vital insight into the market’s positioning. There is a significant amount of OI at 25,500 in the put market, indicating solid support at this level.

The call side has large OI concentrations between 25,000 and 25500 levels. This suggests that the index may struggle to surpass the 25,500 level while traders are betting on the market.

Experts in the field advise caution for traders.

With the options, data signalling increased call writing at higher levels, traders should look for opportunities to buy on dips, with stop-loss strategies set below the 25,500 support level.

Said Mandar Bhojane, Technical Analyst of Choice Broking.

In the chart for daily trading, the Nifty 50 created a positive upward divergence, moving away from its crucial support of 24,700 levels.

The ADX DI line remains a technical concern for the index’s upward trend. Dr Praveen Dwarakanath, Vice President of Hedged, said, “The recovery signs are visible, but traders should keep a close watch on the ADX DI line for further confirmation of an uptrend.”

The Bank Nifty is Bullish Key Resistance in the Future

The Bank Nifty index saw a fantastic rally on Friday, ending 805.40 more points at 52,094.20. A bullish candlestick pattern created on daily charts makes traders optimistic about the upcoming week’s momentum.

The index retreated from its support level at 51,000 levels, and technical indicators like the RSI crossing its median line suggest an increase in the Bank Nifty could see further gains in the next few sessions.

In the words of Dwarakanath,

The daily candle was an engulfing bullish pattern and broke through the initial resistance of 52,000. This indicates that Bank Nifty could continue its upward journey towards the 52,500 level.

A rise in put writing also indicates that Bank Nifty has room to increase further as traders could look for the 53,000-53,500 resistance area.

Aditya Agarwal, the Head of Derivatives & Technical Analysis at Sanctum Wealth, added,

The short-term outlook of Bank Nifty remains positive, and the index is likely to rise towards 52,480 or 52,760 levels. A dip in 51,620 or 51,440 could be viewed as a chance to start the long-term market.

Trading Strategies for Monday

With the expected cautious start for this week ahead, traders are advised to stay attentive and implement a strategy which considers the technical indicators as well as the sentiment of the market.

In the case of Nifty 50, traders are advised to take advantage of the dips as opportunities to buy, with support levels of 24,700 being a crucial threshold. If the price falls below this level, it could lead to a more significant negative movement.

Bank Nifty is in a better position, and Friday’s momentum will likely continue through Monday’s sessions.

Analysts suggest employing the bull call spread strategy to profit from the potential gains. Ganesh Dongre, the Senior Director for Technical Research at Anand Rathi, recommends the following structure for trading.

- Buy 1 lot of 30th October expiry of 52,800 CE at CMP 286

- Sell 1 lot expiring of 30th October 53,300 CE for CMP 144.

This strategy requires a capital investment of around Rs 20,000. It provides a maximum gain of around Rs 4,800 with the potential for a loss of Rs 2,100. Investors should begin accumulating profits around the 53,000 to 53,500 resistance range According to Dongre.

Key Levels to Watch

Nifty 50 traders must look out for the 24,700-24,650 range for immediate support. On the other hand, there is a chance of resistance close to the range of 24,950 – 25,050.

Bank Nifty is currently trading at key support at 51,000, and resistance is between the 52,500 and 53,500 range. A dip towards the 51,620 level could provide a new opportunity for traders who want to exploit the current growth.

Also Read: Forex Update: EUR/USD, AUD/USD, GBP/USD, and EUR/JPY Analysis

The information provided in this article is for general informational purposes only and does not constitute investment advice. The views and analysis expressed are those of SMJ (Stock Market Journal) and are based on current market data and trends. Readers are advised to conduct their own research or consult with a financial advisor before making any investment decisions. SMJ or its affiliates shall not be held responsible for any direct or indirect loss arising from the use of this information. All investments are subject to market risks, including the potential loss of principal.