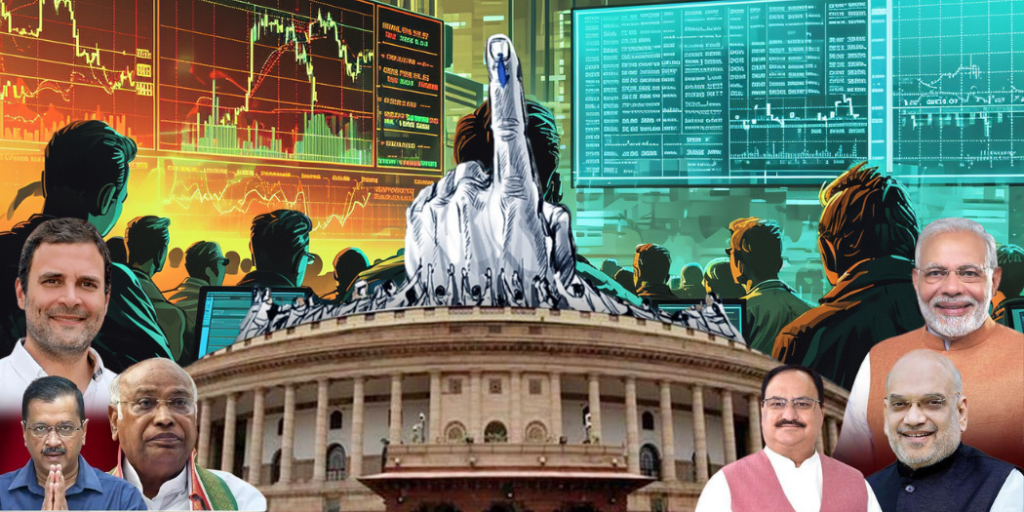

As the anticipation for the Lok Sabha Elections 2024 results reaches its peak, the atmosphere is charged with both excitement and apprehension.

With the results set to be announced on June 4, investors are holding their breath, waiting to see how the market will react. The stakes are high, and the outcome will determine the direction of the Nifty 50 and BSE Sensex, impacting retail investors significantly. In the run-up to the announcement, market analysts have been vocal about their expectations and predictions.

The general consensus among wealth advisors is that the benchmark indices are currently overpriced and a correction is due. However, the extent of this correction hinges on the performance of the BJP-led NDA in the elections.

A weaker-than-expected showing by the ruling party could trigger substantial market volatility, particularly affecting small-cap stocks and funds.

One veteran equity analyst from Mumbai expressed concerns that small-cap stocks might suffer the most if the BJP fails to secure at least 272 seats.

While the Nifty 50 and BSE Sensex might also see a dip, the impact is expected to be less severe for large-cap stocks. This sentiment is echoed by another Mumbai-based equity expert, who believes that a large-cap rally will continue post-election due to several underlying factors.

Investors are adopting a cautious approach, preferring to hold on to cash until the election results are out. This wait-and-see attitude is driven by uncertainty, as most investors are unsure about how the market will respond to the different possible election outcomes.

Ravi Saraogi, co-founder of Samasthiti Advisors, advises against speculating on short-term market movements and recommends waiting for the election results before making any investment decisions.

Anirudh Garg, Partner and Head of Research at Invasset, PMS, outlines the potential market scenarios based on the election outcome. He predicts that a strong BJP majority will bolster market sentiment, leading to a positive response from the indices.

Conversely, a weaker performance by the BJP could introduce market uncertainty and short-term volatility.

If a non-BJP government comes to power unexpectedly, it could result in a market correction similar to the one seen in 2004 when the Congress formed the government against expectations.

Ravi Singh (SVP of Retail Research at Religare Broking) suggests that a strong Modi government majority could trigger a favorable market reaction. However, if a BJP coalition with NDA support comes into play, the market might experience a corrective phase, making investors wary. He speculates that if the Modi government secures a significant majority, the Nifty 50 could reach 24,200 and the Sensex could rise to around 78,500.

Despite the prevailing uncertainty, there is a noticeable trend of active retail investor participation. Sarvjeet Singh Virk, Co-founder and MD of Shoonya by Finvasia, notes that this participation reflects a positive sentiment among investors who are banking on political stability post-election results.

The advice from wealth advisors remains consistent: focus on long-term financial goals and avoid getting swayed by short-term market volatility. Saraogi emphasizes the importance of looking at the larger picture and not overreacting to these significant yet temporary events. He advises investors to craft a solid investment plan, diversify to manage risk, and stay patient during periods of market uncertainty.

As June 4 approaches, retail investors and market participants alike will be closely monitoring the election results, prepared to navigate the market’s reaction. While the immediate future holds uncertainty, a long-term, strategic approach to investing will be key to weathering any potential storms.